Navigating estate planning for blended families requires addressing unique concerns and ensuring consideration for everyone involved. These frequently asked questions will help you understand how to plan effectively for the future.

1. Why is estate planning important for blended families, even if everyone gets along well now?

Even if harmony exists now, future circumstances can change. Estate planning lets you legally document and carry out your wishes, instead of relying on state laws or default arrangements that may not align with your intentions. A strong estate plan helps prevent conflicts and legal disputes in your family, ensuring your assets are distributed according to your wishes.

2. If my spouse and I own property jointly, do we still need a will or trust?

While joint ownership with survivorship rights can avoid probate, it doesn’t address every scenario. For instance, if you and your spouse were to pass away simultaneously, the jointly owned property would need to go through probate. Additionally, if your spouse outlives you, they would have full control over the jointly owned property, which could potentially prevent your children from a previous marriage from receiving any benefit. Therefore, a will or trust is important to ensure all contingencies are covered.

3. Should I be concerned about potential divorce among my children or stepchildren, and how can estate planning help?

Even though your children are currently happily married, the possibility of a future divorce is still very real. Estate planning can help protect your assets from becoming a financial benefit for a future ex-spouse if your child’s marriage ends in divorce. Proactive planning ensures your assets are distributed as you wish and protects your family’s financial future.

4. How can I balance the interests of my children from a previous relationship with those of my current spouse?

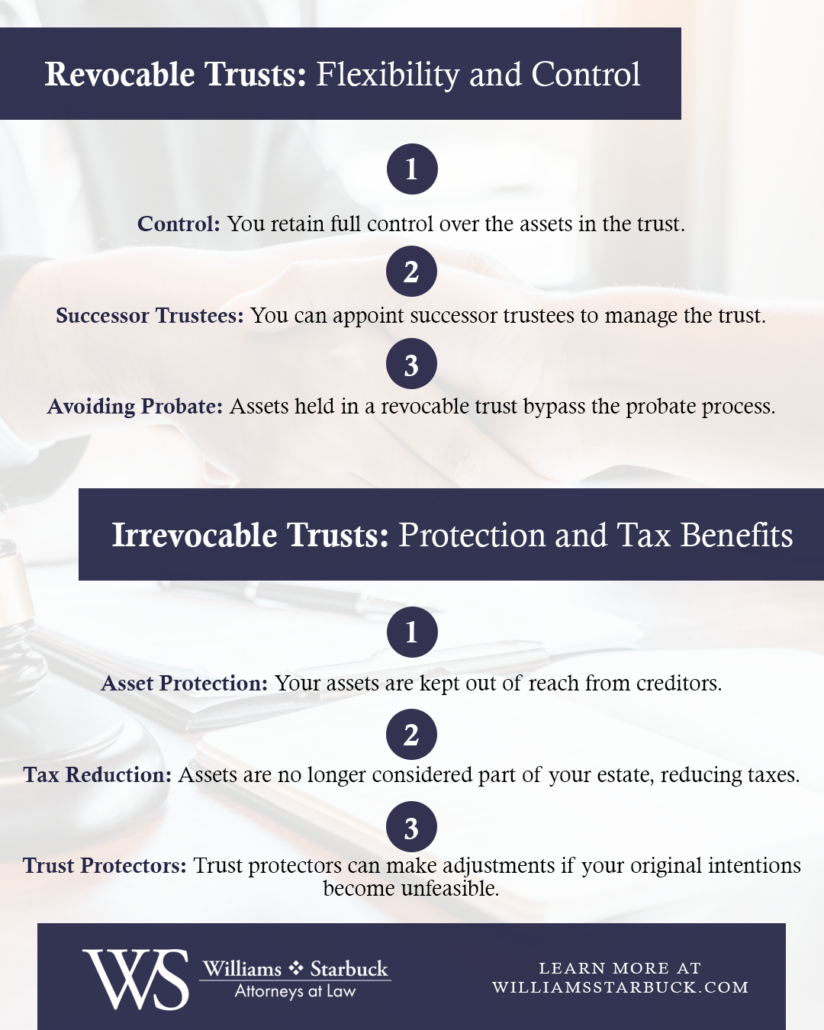

Carefully balancing the interests of your children from a previous relationship with those of your current spouse requires intentional planning. Tools like trusts help you manage and fairly distribute your assets to everyone involved. A well-structured estate plan ensures your children and spouse are both provided for, minimizing conflict and ensuring your wishes are carried out.

Need Assistance with Estate Planning for Blended Families?

Effective estate planning for blended families requires thoughtful guidance. At Williams Starbuck Attorneys at Law, we specialize in creating comprehensive estate plans that reflect your unique family dynamics and protect your loved ones. Contact us at 702-320-7755 to schedule a consultation and start planning for a secure future today!