Trusts are a fundamental tool in estate planning, offering numerous benefits such as avoiding probate, minimizing taxes, providing organization, and maintaining control over your assets. At its core, a trust is a legal document that outlines your wishes, guiding your loved ones on what to do and when.

Understanding Revocable vs Irrevocable Trusts

While there are many types of trusts, the primary distinction lies between revocable and irrevocable trusts. Each serves a different purpose and offers unique benefits.

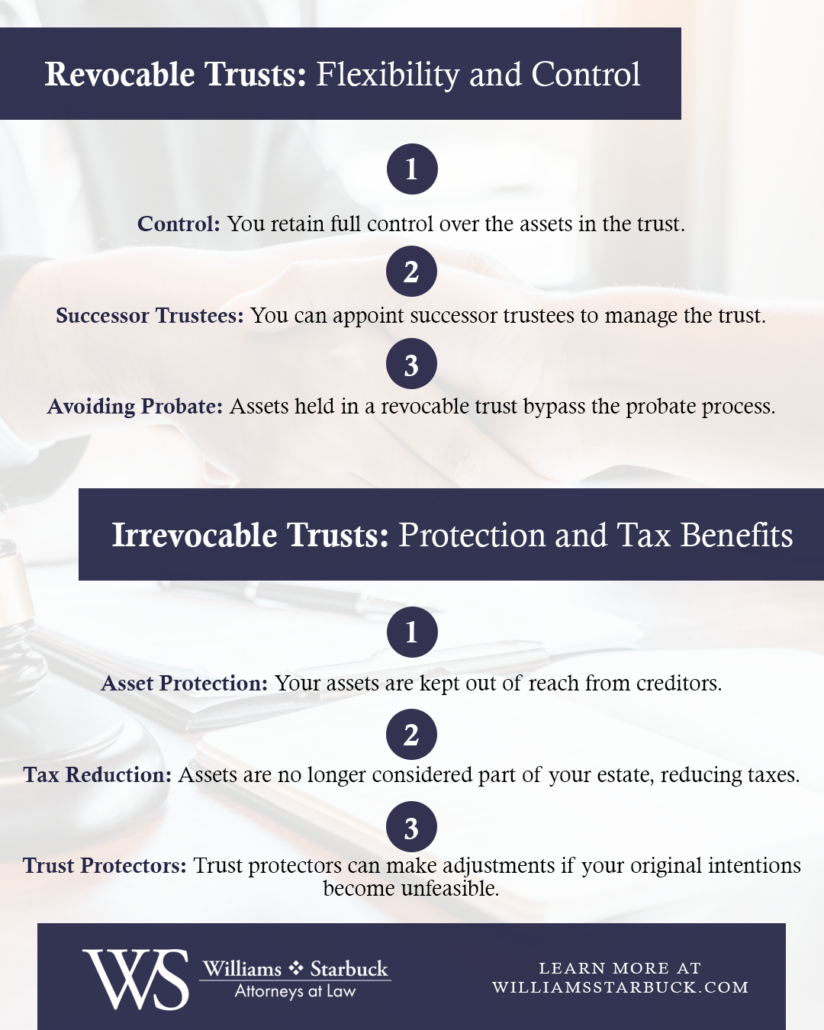

Revocable Trusts: Flexibility and Control

Revocable trusts, often referred to as “living trusts,” are designed to benefit you during your lifetime. The key advantage of a revocable trust is its flexibility; you can alter, change, modify, or even revoke the trust entirely if your circumstances or goals change.

- Control: With a revocable trust, you retain full control over the assets. You can transfer property in and out of the trust, serve as the trustee, and be the primary beneficiary.

- Successor Trustees: You can appoint successor trustees to manage the trust if you become incapacitated or upon your passing, ensuring that your assets are handled according to your wishes without court intervention.

- Avoiding Probate: Assets held in a revocable trust bypass the probate process, making it more difficult for creditors to access them. This protection is a significant advantage for those looking to safeguard their beneficiaries’ inheritances.

Irrevocable Trusts: Enhanced Protection and Tax Benefits

In contrast, irrevocable trusts involve transferring assets out of your estate and into the trust’s name. Once established, you cannot alter, change, modify, or revoke the trust, making it a more permanent arrangement.

- Asset Protection: Irrevocable trusts provide greater asset protection, keeping your assets out of reach from creditors.

- Tax Reduction: Because the assets are no longer considered part of your estate, they often reduce estate taxes.

- Trust Protectors: Although you lose direct control, trust protectors can make adjustments if your original intentions become unfeasible due to changes in law or circumstances.

Which Trust is Right for You?

Choosing between a revocable and irrevocable trust depends on your unique needs and goals. As experienced estate planning attorneys, we can help you determine which option best fits your situation. Contact Drew Starbuck at 720-660-9847 to schedule an appointment and ensure your estate is in good hands.